Our firm

We see investing as a journey and we seek to create value for our clients every step of the way. We invest for the long term, employing our global investment and risk capabilities and sustainable investing expertise to create innovative solutions that anticipate future needs. We believe in solving not selling – our goal is to elevate the investment experience for clients, wherever they are based and whatever their investment objectives.

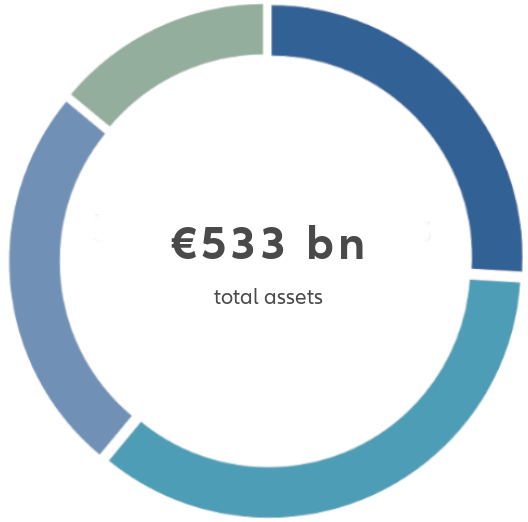

We are active investors

We have EUR 533 billion in assets under management for institutional and retail investors worldwide. We offer equity, fixed-income, private market and multi-asset strategies. Our expertise ranges from the developed world to emerging markets, from single-country to global strategies, and from thematic to sector portfolios. Through active asset management, our goal is to ensure a superior experience for our clients, wherever they are based and whatever their investment needs.

Data as at 31 December 2023.

Total assets under management are assets or securities portfolios, valued at current market value, for which Allianz Asset Management companies are responsible vis-á-vis clients for providing discretionary investment management decisions and portfolio management, either directly or via a sub-advisor. This excludes assets for which Allianz Asset Management companies are primarily responsible for administrative services only. Assets under management are managed on behalf of third parties as well as on behalf of the Allianz Group. Source: Allianz Global Investors. Any differences in totals are due to rounding.

We collaborate globally

We aim to ensure the highest service standards by sharing insights across regions. We employ over 600 investment professionals in 20 offices worldwide. We do not have a designated head office: our center of gravity is our clients. We focus on creating value with them by forming a long-term partnership.

Data as at 31 December 2023. *Including Sales (responsible for client acquisition and contact) and Account Management (responsible for existing client account services).

Further information

|

31/12/2023

|

||

|

31/12/2023

|

||

|

31/12/2023

|